Capital gains tax

Contents |

[edit] Overview

Capital Gains Tax (CGT) is levied on the profit that is made when something is sold, gifted, swapped or otherwise disposed of.

The following assets are liable to Capital Gains Tax:

- Property. If it is not the main home (unless it is let out, used for business or larger than 5,000 square metres).

- Shares that are not in a NISA, ISA or PEP.

- Personal possessions that are worth more than £6,000 (apart from a personal car).

- Business assets.

- Overseas assets.

[edit] Property

Property that is liable to Capital Gains Tax includes:

- Second homes.

- Any rental properties.

- Business premises.

- Land, including agricultural land.

The selling of a main home will not generally be liable to Capital Gains Tax and may be eligible for Private Residence Relief.

[edit]

The investments that are liable to Capital Gains Tax include:

[edit] Personal possessions

The majority of personal possessions that are worth more than £6,000 are liable to Capital Gains Tax, including:

- Jewellery.

- Antiques.

- Paintings.

- Coins and stamps.

- Possessions that are part of a set, such as matching vases (the threshold applies to the set as a whole).

[edit] Business assets

Numerous business assets are liable to Capital Gains Tax and typically include:

- Buildings and land.

- Fixtures and fittings.

- Shares.

- Plant and machinery.

- Goodwill.

- Registered trademarks.

[edit] Overseas assets

For residents in the UK, overseas assets are liable to Capital Gains Tax, including:

- Holiday homes.

- Shares in a foreign company.

- Land abroad purchased for development.

[edit] When Capital Gains Tax is not required

Capital Gains Tax is only required on any gains which are in excess of the tax-free allowance, which for 2013-2014 is:

- £10,900 for individuals.

- £5,450 for trustees.

It is not normally necessary to pay Capital Gains Tax on gifts between husband and wife, civil partner or to charities. In addition, Capital Gains Tax on inheritance is typically only required when an asset is sold.

The following assets are not liable:

- Personal car.

- Personal possessions that are disposed of for less than £6,000.

- Main home.

- Any tax free investment savings accounts e.g. ISAs and PEPs.

- Winnings from the lottery, betting or the pools.

- UK government gilts and Premium Bonds.

- Personal injury compensation.

- Foreign currency for personal use.

[edit] Rates for Capital Gains Tax

The rates for Capital Gains Tax for 2013-14 are:

- 18% and 28% for individuals (dependent on the total amount of taxable income).

- 28% for trustees or for personal representatives of someone who has died.

- 10% for sole traders or partnerships with gains qualifying for Business Asset Disposal Relief or BADR (formerly known as Entrepreneurs' Relief).

[edit] Reporting Capital Gains Tax

If Capital Gains Tax needs to be paid, HM Revenues and Customs (HMRC) will require notification through a tax return. This can be completed online or alternatively on paper.

[edit] Record keeping

It is necessary to maintain any records for at least one year after the Self Assessment deadline and businesses must maintain records for 5 years after the deadline.

[edit] Related articles on Designing Buildings Wiki.

- Business Asset Disposal Relief BADR.

- Business rates.

- Capital.

- Capital allowances.

- Capital gain.

- PAYE.

- Stamp duty.

- Taxes associated with selling a business.

- Tax relief.

- VAT.

[edit] External references

Featured articles and news

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

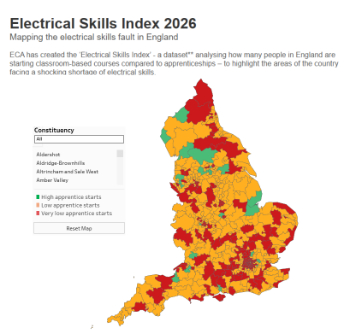

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

A detailed description fron the experts at Cornish Lime.

IHBC planning for growth with corporate plan development

Grow with the Institute by volunteering and CP25 consultation.

Connecting ambition and action for designers and specifiers.

Electrical skills gap deepens as apprenticeship starts fall despite surging demand says ECA.

Built environment bodies deepen joint action on EDI

B.E.Inclusive initiative agree next phase of joint equity, diversity and inclusion (EDI) action plan.

Recognising culture as key to sustainable economic growth

Creative UK Provocation paper: Culture as Growth Infrastructure.

Futurebuild and UK Construction Week London Unite

Creating the UK’s Built Environment Super Event and over 25 other key partnerships.

Welsh and Scottish 2026 elections

Manifestos for the built environment for upcoming same May day elections.

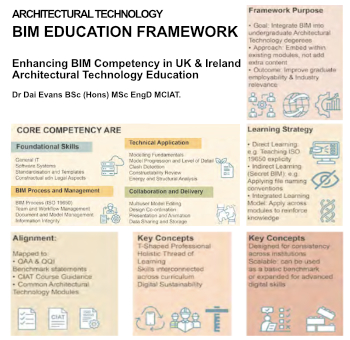

Advancing BIM education with a competency framework

“We don’t need people who can just draw in 3D. We need people who can think in data.”

Guidance notes to prepare for April ERA changes

From the Electrical Contractors' Association Employee Relations team.

Significant changes to be seen from the new ERA in 2026 and 2027, starting on 6 April 2026.

First aid in the modern workplace with St John Ambulance.

Solar panels, pitched roofs and risk of fire spread

60% increase in solar panel fires prompts tests and installation warnings.

Modernising heat networks with Heat interface unit

Why HIUs hold the key to efficiency upgrades.